Troubleshooting Globalization

At 25, Brandeis International Business School has found its niche.

by Frank Gibney Jr.

In the late 1980s, in the wake of the Latin American debt crisis but before the fall of the Berlin Wall and the spectacular crash of Japan’s economy, Peter Petri had a palpable sense that transactions around the world were speeding up and beginning to intertwine, often with unintended consequences for corporations — and countries.

“The world was changing fast,” recalls Petri, then an associate professor of economics at Brandeis. The “third world” was becoming the “developing world.” Parts of the developing world were soon developed. If mighty Japan was in trouble, other East Asian economies were surging ahead. Latin America, too, was on the move again.

Nothing less than an “economic earthquake” was underway, Petri says. The economic imbalances, not to mention the social and political upheaval, begged for new rule books for business policy and the analysis of business opportunities.

A graduate professional school focused on the world’s rapidly interconnecting economies could add value, Petri and some of his economist colleagues believed. “We wanted to explore the workings of the global economy, and design a comprehensive and intellectually demanding program on the practical implications of all this change,” he explains.

The question was how to leverage the Brandeis economics department’s strengths in the new international arena. Petri and his colleagues didn’t want to create a traditional — read “Harvard” — business school. In that arena, a tiny upstart would struggle to compete for students. Also, Petri says, “we saw general management as a genteel field that belonged to the Establishment.”

After much discussion, Petri and his colleagues determined their approach. “Finance was the quickest way to get to the nuts and bolts of how the world was changing,” he says.

Advocating an ambitious business curriculum focused on globalization — before that trend’s economic significance was recognized as critical — was initially a hard sell. But today Brandeis International Business School, which celebrates its 25th anniversary this year, is well-positioned to explore and troubleshoot the systemic shortcomings, rolling crises and collateral effects caused by societies grappling with rapid change.

Consider these examples: The European Union deals with a refugee influx and ultra-nationalist, authoritarian governments on its fringes. Britain has elected a volatile former journalist as its prime minister. Russia seems to lurk everywhere, particularly in cyberspace, conducting proxy attacks on Western financial and political systems. Traditional currencies are being threatened by blockchain technology. The United States and China, the world’s two most powerful economies, are engaged in a slugfest over a massive trade imbalance and bragging rights to next-generation technologies in sensitive areas like artificial intelligence and cellular communications.

The International Business School’s founding was prescient — if anything presents a challenge for the leaders of countries and companies, it’s negotiating economic interdependence in a digital world that was unimaginable 25, or even 10, years ago. And its brand is rooted in scrappy “hard” fields, such as the economics of exchange rates, new financial instruments, data analytics and fintech.

The Lemberg Program in International Economics and Finance, the business school’s earliest direct ancestor, was launched informally in 1987 in an entrepreneurial atmosphere, with Petri as its founding director. It offered a master’s degree to an initial class of 12. In 1994, the Lemberg Program and a new PhD program were institutionalized as the Graduate School of International Economics and Finance, with Petri as dean. Fifty students from a handful of countries were enrolled, including many Fulbright Scholars, a practice that continues today.

In 2003, the school was renamed once again, as Brandeis International Business School. As it grew, it added faculty at the frontiers of the new world of business, including Stephen Cecchetti, the Rosen Family Chair in International Finance, formerly chief economist at the Bank for International Settlements; former faculty member Catherine Mann, who was chief economist at the Organization for Economic Cooperation and Development; and associate professor of finance Anna Scherbina, a senior economist at the

U.S. Council of Economic Advisers and an expert on cybersecurity analysis.

This fall, the International Business School welcomed an entering class of almost 300 students representing more than 30 countries — now, that’s globalization.

Petri, the Carl J. Shapiro Professor of International Finance, and a nonresident scholar at the Brookings Institution, is disarmingly relaxed for someone who is often trying to solve several multilayered trade puzzles at the same time. His work extends far beyond Waltham to Washington, D.C.; Europe; and Asia — particularly Japan and China — where he strategizes with counterparts and policymakers.

China’s economic development in recent decades enabled it to leapfrog directly into the digital era, leaving many international analysts scratching their heads. In response, the business school curriculum — by emphasizing experiential learning and a familiarity with globalized, data-driven transactions — is producing adept, innovative corporate and government economists, and investment managers.

Courtesy Brandeis International Business School

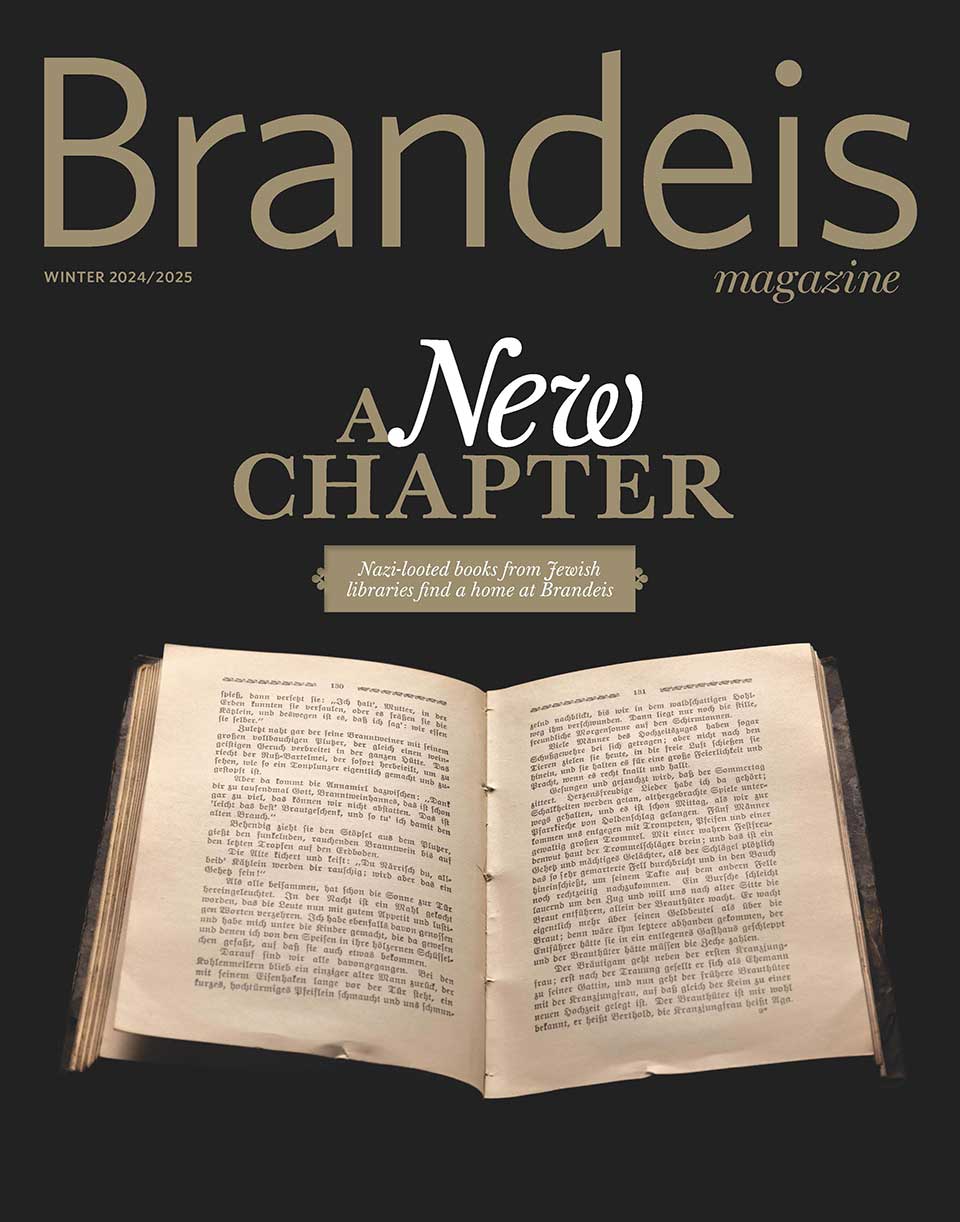

EXPANSION: Breaking ground on the business school’s Lemberg Academic Center in 2002.

page 2 of 2

These alumni now work everywhere — London, Shanghai, New York City, Hong Kong, Berlin and Tokyo, to name just a few crossroads of global decision making. “In an environment like this, it’s very important to continue expanding relationships around the world,” says Kathryn Graddy, the Fred and Rita Richman Distinguished Professor in Economics, who became dean in 2018. “Whether it’s China, India or Japan, this is when we double down.”

Graddy is already laying a foundation for the next 25 years. “We are academically rigorous, experiential and global,” she says. The International Business School’s quantitative strength has been reinforced: All its programs are now STEM-designated, enabling eligible international students to work in the U.S. for up to three years after graduation. The curriculum includes the Hassenfeld Fellow Overseas Immersion Program, which offers students hands-on experience at companies around the world, a feature not found at many business schools.

Though seemingly counterintuitive for a school Graddy calls Brandeis’ “global arm,” its core mission can be summed up by an adjective rarely applied to business schools: “human.” “We care deeply about preparing individuals to be global leaders,” Graddy says.

The humanistic focus dates back to the school’s early days. Board of Trustees member Lan Xue ’90, MA’91, who graduated in the Lemberg Program’s second class, came to Brandeis as an undergraduate through a Wien International Scholarship. Today, she runs a billion-dollar global hedge fund from Hong Kong and Shanghai. Xue has given Brandeis $1 million for student scholarships. “One part of American culture I value a lot is the idea that you pay it forward,” she says. “I’m now in a position where I can contribute to what I hope will be a boost for the next generation.”

Chinese students represent the single largest international group at the business school; at Brandeis generally; and at U.S. universities, where, this year alone, 360,000 Chinese men and women are enrolled. For the most part, the Chinese students who came to Brandeis in the 1980s had little money, relying on Chinese government funding or scholarship programs like the Wien to pay for their education. Most enrolled as undergraduates. By the late 1990s, the number of Chinese students entering Brandeis was greater, and most were going directly to the business school.

Petri — who, while consulting in Asia for the World Bank, had met many high-performing U.S.-educated Chinese officials — realized China could be a key area of focus for the school. Today, in fact, a couple of International Business School alumni work within the World Bank’s top tiers. More than that, business school alumni have been spreading the word about Brandeis in China for 25 years, attracting Chinese students to IBS as well as to graduate and undergraduate programs in scientific research and computer science.

So far, more than 1,400 Chinese alumni — most of them International Business School graduates — have returned to China. President Ron Liebowitz hopes to establish a presence in China, to add cohesion to the alumni community and ease future graduates’ transition to the workforce. In addition, he says, he’d like to see more Brandeis undergraduates study abroad in China.

To underscore his interest, Liebowitz made his first trip to China in April, returning again in July for a working vacation. As the U.S. and China try to negotiate a difficult time in their relationship, the Chinese “seem very appreciative that we are making the effort to be in China,” says Graddy.

During the April trip, Liebowitz presented Roberta Lipson ’76, who exemplifies the ever-expanding range of business opportunities in China, with the 2019 Asper Award for Global Entrepreneurship. In 1994, Lipson co-founded what has become one of China’s largest networks of private hospitals and modern health-care facilities. In July, her company, United Family Healthcare, was acquired by New Frontier Corp. and will be listed on the New York Stock Exchange.

At the end of the award ceremony, in front of a predominantly Chinese audience of 150 International Business School alumni, parents and friends, Lipson’s acceptance remarks were characteristically modest. “Brandeis gives its students the opportunity to pursue their passions,” she said in colloquial Mandarin. “For that, I am forever grateful.”

Frank Gibney Jr. is a writer and editor. He often writes about East Asia, where he was a correspondent for Newsweek and Time during the 1980s and ’90s.