Steve: Weathering the COVID-19 storm

Steve, a 56-year old white American man, has worked in the restaurant industry since he was sixteen. Today he is one of three partners who own and run successful restaurants in Arlington and Cambridge, Massachusetts. He is married and the father of a young daughter.

Photo Credit: Sarah Putnam (all photos)

Steve grew up with three younger siblings in an upper middle-class Connecticut suburb. His father was a doctor who provided a comfortable lifestyle for his family. When Steve was twelve his parents divorced and his mother, who had been a homemaker, began working in banking and eventually in real estate. His parents’ relationship was acrimonious following the divorce, but they worked hard to minimize the negative effects of their separation on their children.

When Steve was 16, he started a part-time job. He wanted to pay for his own incidental expenses and save money for college. Growing up, Steve’s parents taught him the value of financial responsibility and independence: “When I wanted something like a radio, my parents gave me half the money for it and the rest I had to earn. We could earn money around the house doing chores or we could babysit for the neighbors.” His first job was at a local Friendly’s restaurant as a dishwasher and occasional server. He felt an instant, visceral attraction to the work: “I loved the energy of it. I loved the multitasking of it. I loved the people interaction of it.”

When Steve was 16, he started a part-time job. He wanted to pay for his own incidental expenses and save money for college. Growing up, Steve’s parents taught him the value of financial responsibility and independence: “When I wanted something like a radio, my parents gave me half the money for it and the rest I had to earn. We could earn money around the house doing chores or we could babysit for the neighbors.” His first job was at a local Friendly’s restaurant as a dishwasher and occasional server. He felt an instant, visceral attraction to the work: “I loved the energy of it. I loved the multitasking of it. I loved the people interaction of it.”

In high school, Steve was a high-achieving student who excelled in English and Social Studies classes. Extroverted and well-spoken, he was encouraged to think of a career in law. With a pre-law track in mind, Steve enrolled at the University of Connecticut and took a job at a local restaurant to earn spending money, continuing to cultivate his skills in the field.

In his second year of college, Steve came to the realization that what he really wanted was a career in the restaurant business. When he was offered a position as a manager at the restaurant, he decided to take it and put college aside for the time being.

In the years that followed Steve worked at several large restaurant chains. He went through training programs and advanced to positions of greater seniority. In 2010, he, along with two partners, decided to take the plunge and open their own restaurant. The corporate restaurants in which Steve had built his career had given him valuable training and experience. Now he was anxious to bring his own creativity and innovations to the business. He took a substantial pay cut and used a financial gift inherited from an aunt for an initial investment. He and his partners then took out a business loan to start their first restaurant.

In the years that followed Steve worked at several large restaurant chains. He went through training programs and advanced to positions of greater seniority. In 2010, he, along with two partners, decided to take the plunge and open their own restaurant. The corporate restaurants in which Steve had built his career had given him valuable training and experience. Now he was anxious to bring his own creativity and innovations to the business. He took a substantial pay cut and used a financial gift inherited from an aunt for an initial investment. He and his partners then took out a business loan to start their first restaurant.

Over the ten years of building and expanding their business, Steve and his partners have always been fully involved in the day-to-day running of the restaurants: “The three of us, we're all very hands-on restaurant partners. This is our primary occupation. This is what we do. It's not an investment for us. On a typical day pre-COVID, I worked about 11 hours a day, on average 60 hours a week.” Each partner brings a unique skill-set - in food preparation, accounting and restaurant management - to the business. In his role as general manager, Steve is responsible for the “front-of-house” or the customer service aspects of the business, as well as being in charge of hiring, training, and supervising a staff of about 75 people.

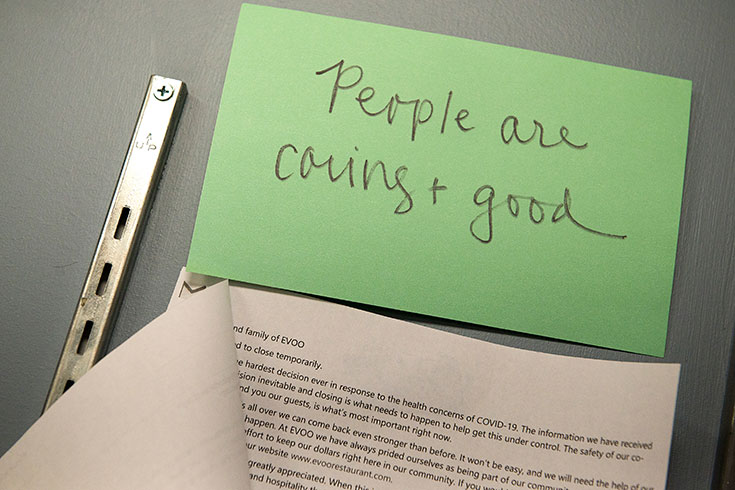

In March 2020, COVID-19 stormed through the country, bringing in-person restaurant dining to a halt. Like other restaurant owners, Steve went through the painful task of furloughing staff: “It was an emotional time. I had to tell them, you know, we just don’t have hours for you, I can’t employ you. We'll be here to support you as best we can. We hope to bring you back soon and in the meantime you can collect unemployment. But right now, there won't be a restaurant to reopen if we just continue to pretend that this is not a real thing.”

By the end of 2020, Steve and his partners had placed two of their restaurants into “hibernation,” temporarily closing their doors. This included Za in Cambridge, an eatery serving gourmet pizza and salads and EVOO, the restaurant next to it offering new American cuisine. Za in Arlington moved to a takeout and outdoor dining model. As profits took a nose dive they were anxious about losses. The shuttered restaurants were not making money but still had the fixed costs of rent, utilities, maintenance and insurance. To save funds for the business, the partners decided not to pay themselves for the time being. Steve, like his furloughed staff, began to collect unemployment checks. Luckily for him, he had savings to dip into, and also the income from his wife’s work as an architect.

By the end of 2020, Steve and his partners had placed two of their restaurants into “hibernation,” temporarily closing their doors. This included Za in Cambridge, an eatery serving gourmet pizza and salads and EVOO, the restaurant next to it offering new American cuisine. Za in Arlington moved to a takeout and outdoor dining model. As profits took a nose dive they were anxious about losses. The shuttered restaurants were not making money but still had the fixed costs of rent, utilities, maintenance and insurance. To save funds for the business, the partners decided not to pay themselves for the time being. Steve, like his furloughed staff, began to collect unemployment checks. Luckily for him, he had savings to dip into, and also the income from his wife’s work as an architect.

By mid-2021, things were starting to look up. They had reopened Za in Cambridge and were expecting to start serving at EVOO by the fall. With the availability of vaccinations and the easing of restrictions on gatherings of people, the restaurant business had picked up. Steve and his partners were also able to draw on federal assistance programs as they worked to re-open and rebuild their restaurants. They received a small business loan from the federal Paycheck Protection Program (PPP), established in 2020 through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). In 2021 they took advantage of the Restaurant Revitalization Fund (RRF) of the American Rescue Plan Act, which provides funding to help restaurants and other eligible businesses keep their doors open. These resources, along with their skills, experience and creativity, had enabled them to weather the storm.