Sir Ronald Cohen will receive the 2022 Perlmutter Award for Excellence in Global Business Leadership on April 14.

Sir Ronald Cohen celebrated his 60th birthday in 2005 by leaving behind a wildly successful career in the venture capital industry.

“I didn’t want my epitaph to read, ‘He delivered the 30 percent rate of return for 15 years,’” said Cohen. “I left because I wanted to do what I considered to be more important things.”

A pioneering philanthropist, venture capitalist, private equity investor and social innovator, Cohen is recognized as the father of impact investment and European venture capital. His 2020 book, “IMPACT: Reshaping Capitalism to Drive Real Change,” was a Wall Street Journal Best Seller. Cohen currently serves as chairman of the Global Steering Group for Impact Investment, the Impact-Weighted Accounts Project at Harvard Business School, and The Portland Trust.

On April 14, Cohen will receive the 2022 Perlmutter Award for Excellence in Global Business Leadership. The award is given to a highly select group of individuals whose careers embody the values promoted by the Perlmutter Institute for Global Business Leadership — a vision that transcends national borders, the highest levels of professionalism and a commitment to the global community and its prosperity.

The event, which is sponsored by the Perlmutter Institute and Office of the President, is part of the International Business School’s annual Business of Climate Change program. Register now.

In anticipation of the award ceremony, Cohen reflected on impact investment, his childhood experience as a refugee and the perks of sticking to your principles.

Investors and businesses can no longer strive to make profits without worrying about the environmental and social consequences of their actions. We must shift our economies to deliver both profits and solutions to our great challenges. We can achieve the transition from risk-return to risk-return-impact by measuring the impacts companies create on people and the planet through their operations, employment, products and supply chains.

Venture capital and private equity drive innovation that disrupts the business models of companies that pollute the environment or perpetuate social ills. Tesla, which was venture capital backed, is a good example. It is a company that strives to do well by doing good, and it has moved the automobile industry away from the pollution of the combustion engine to electric vehicles.

I have been greatly helped in my life. I was welcomed in the U.K. as a refugee, had my education paid for by the British government and scholarships. I am a firm believer that ability is evenly spread, but that opportunity is not. I want to help others in my turn.

Start young, think big and stick with it. And don’t take shortcuts — principles have a cost, but they are always a bargain in the end.

2022 Perlmutter Award Video

Featured Stories

News Categories

@BrandeisBusiness Instagram

View this profile on InstagramBrandeis Intl. Business School (@brandeisbusiness) • Instagram photos and videos

May 19, 2025

Celebrating the Class of 2025: ‘This is our moment!’

September 12, 2024

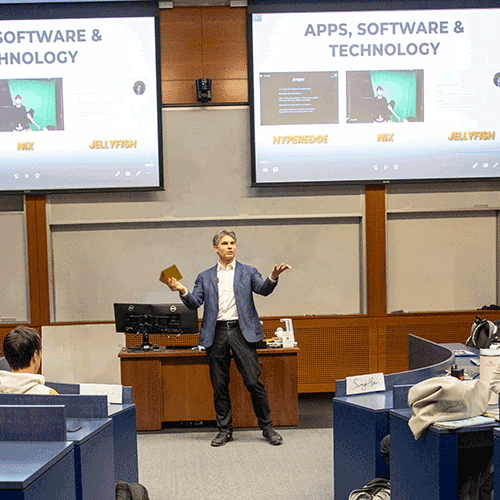

Inspiring student entrepreneurs, one startup at a time